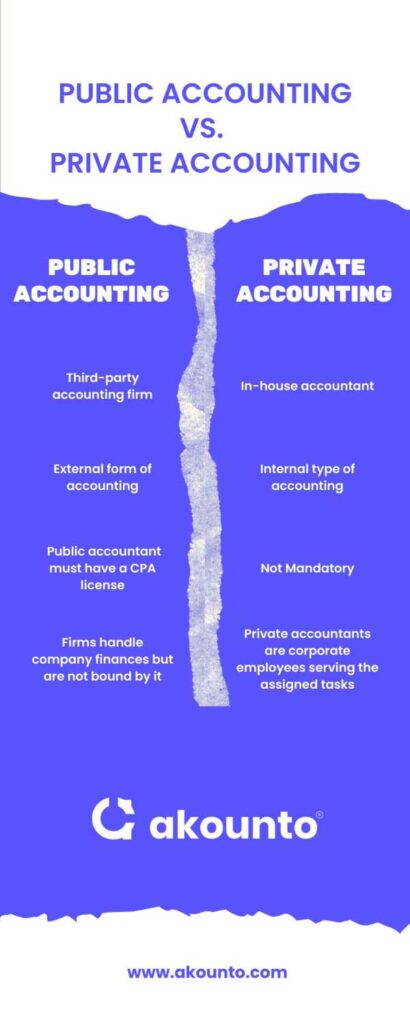

Understanding the nuances between different branches of accounting is essential for individuals contemplating a career in this dynamic field. Accounting primarily divides into two significant categories: public accounting and private accounting. Each serves distinct purposes, requires specific skill sets, and presents unique career opportunities.

Definition of Public Accounting

Public accounting refers to the services performed by accountants who work for public accounting firms or operate independently. These professionals provide a range of services to multiple clients, which can include individuals, businesses, and governmental entities. Public accountants, many of whom hold the title of Certified Public Accountant (CPA), engage in various activities, such as:

- Auditing: Reviewing financial statements for accuracy and compliance.

- Tax Preparation: Helping clients prepare and file their tax returns.

- Consulting: Offering financial advice to optimize clients’ strategies and operations.

Public accountants are often busiest during tax season, tirelessly working to ensure their clients meet filing requirements and maximize their deductions.

Definition of Private Accounting

In contrast, private accounting is conducted by accountants who are employed by a single organization, often referred to as corporate accountants. These professionals have a deeper understanding of the company’s unique financial context and internal processes. Private accountants are typically involved in:

- Budgeting: Developing organization-specific budgets to guide financial decisions.

- Financial Analysis: Analyzing data to forecast future financial performance.

- Internal Auditing: Ensuring that internal controls are operating efficiently and effectively.

They usually experience peak workloads at the end of fiscal quarters when financial reporting is essential, ensuring that the organization maintains its financial health and compliance. These definitions highlight the fundamental distinctions between public and private accounting, paving the way to explore the critical differences in their operations and work environments.

Key Differences Between Public and Private Accounting

Understanding the distinctions between public and private accounting is crucial for anyone interested in pursuing a career in finance. These two branches, while sharing common goals of ensuring accurate financial reporting and analysis, differ in several key areas including reporting standards and clientele.

Reporting Standards

One of the fundamental differences between public and private accounting lies in the reporting standards they must adhere to. Public accountants are subjected to strict guidelines laid out by regulatory bodies, such as the Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS). This adherence ensures transparency and consistency when public companies disclose their financial statements to stakeholders. For private accountants, however, the reporting standards may vary depending on their company’s requirements. They typically follow GAAP for internal reporting, but there’s room for flexibility. Internal reports may be tailored to provide insights that are relevant to management decision-making, rather than meeting external compliance standards.

Clientele

The clientele served by these two types of accountants provides another lens through which to view their differences. Public accountants work externally, providing services to a broad range of clients, including:

- Large corporations

- Small businesses

- Non-profit organizations

- Government agencies

This diverse clientele affords public accountants the opportunity to gain a wide-ranging experience across various industries. On the flip side, private accountants are employed exclusively by one organization. They focus on catering to that entity’s financial needs, which allows them to develop specialized knowledge relevant to that particular industry. For instance, a private accountant working in a manufacturing company will develop insights crucial for that sector, such as cost control and inventory management. These differences in reporting standards and clientele between public and private accounting underscore the unique roles and responsibilities associated with each career path, helping aspiring accountants make informed decisions about their futures.

Job Opportunities in Public Accounting

As accountants weigh their career options, public accounting presents a unique set of roles and responsibilities coupled with promising career progression. Those embarking on a journey in public accounting will find a dynamic work environment filled with challenges and rewards.

Roles and Responsibilities

Public accountants perform a variety of essential tasks that are crucial for their clients’ financial stability and regulatory compliance. Some key responsibilities include:

- Preparation and Examination of Financial Statements: Public accountants ensure accuracy and compliance with accounting standards, producing vital documents for stakeholders.

- Tax Planning and Preparation: By identifying tax-saving opportunities, accountants help clients efficiently manage their tax obligations and file returns on time.

- Conducting Audits: Auditors assess financial records, internal controls, and compliance, providing insights for improving organizational processes.

- Offering Financial Consulting: Public accountants provide strategic advice on a range of financial matters, from mergers to capital investments.

Successful public accountants often thrive on interaction, as they frequently collaborate with diverse clients and industries, adapting their expertise to meet unique financial needs.

Career Progression

The path in public accounting can be both lucrative and rewarding. Accountants typically start as entry-level auditors or tax associates. Here’s a general outline of career progression:

- Entry-Level Roles: Beginning as a staff accountant, professionals develop foundational skills and gain practical experience.

- Senior Associate or Senior Accountant: With increased responsibility, accountants manage client accounts and begin honing leadership skills.

- Manager: Overseeing teams and client relationships, managers handle more complex engagements and ensure compliance with regulations.

- Senior Manager or Director: Professionals at this level lead entire departments and develop strategic initiatives within their firms.

- Partner: The pinnacle of public accounting careers, becoming a partner involves equity stakes in the firm, business development, and high-level client management.

This upward trajectory provides not only salary increases but also opportunities for professional influence and decision-making, making public accounting a pathway filled with potential.

Job Opportunities in Private Accounting

Transitioning from public to private accounting can often feel like delving into a different world, where the focus shifts from serving multiple clients to honing in on the financial health of a single organization. Exploring the roles and responsibilities along with career progression in private accounting reveals a stable and rewarding career pathway.

Roles and Responsibilities

Private accountants, also known as corporate accountants, play vital roles within a company, ensuring its financial operations run smoothly. Their duties often include:

- Financial Reporting: They prepare and maintain comprehensive financial statements, which provide insights into the organization’s overall performance.

- Budgeting and Forecasting: Private accountants assist in creating budgets and forecasts, guiding the company’s financial planning and strategic decision-making.

- Cost Analysis: Conducting cost analysis enables accountants to identify potential savings and enhance overall financial efficiency.

- Compliance Management: They ensure adherence to accounting standards and regulatory requirements, safeguarding the organization from legal repercussions.

- Internal Auditing: Evaluating the effectiveness of financial operations, they perform regular audits to implement risk management strategies.

In this role, private accountants develop strong analytical skills and a detailed understanding of their organization’s financial dynamics, enabling them to provide valuable insights to management.

Career Progression

The career trajectory in private accounting is both structured and promising. Entry-level positions, such as Staff Accountant, often serve as a launching pad. As professionals gain experience, they typically progress through several key roles:

- Mid-Level Positions: Moving up, they might become Financial Analysts or Senior Accountants, where they tackle more complex tasks and contribute to strategic decisions.

- Managerial Roles: With further experience, they can advance to roles like Accounting Manager or Financial Controller, overseeing accounting teams and driving critical company initiatives.

- Executive Positions: The ultimate goal for many may be to achieve a position such as Chief Financial Officer (CFO), responsible for the organization’s overall financial strategy.

Throughout this progression, private accountants have the opportunity to gain additional certifications, such as CMA (Certified Management Accountant), which further enhances their career prospects and marketability. This clear path offers not just stability, but also the potential for significant professional growth within a single organization.[7][8]

Work Environment

The work environment significantly influences job satisfaction and career growth in accounting. Understanding the culture in public versus private accounting helps prospective accountants make informed decisions about their career paths.

Culture in Public Accounting

Public accounting firms are characterized by a fast-paced and dynamic culture. Accountants in this sector often juggle multiple clients, which can create a vibrant yet demanding atmosphere. Here are some defining features of public accounting culture:

- Client Interaction: Public accountants regularly engage with diverse clients, from individuals to large corporations. This fosters a strong emphasis on communication and relationship-building.

- Teamwork: Collaborative efforts are essential among teams, particularly when preparing financial statements or conducting audits. Accountants often rely on collective expertise to navigate complex financial scenarios.

- High Pressure and Flexibility: Many public accountants face tight deadlines, especially around tax season. This environment demands adaptability, as unexpected challenges may arise that require quick thinking and problem-solving.

- Continuous Learning: Public accountants often participate in ongoing training and professional development, keeping up with regulatory changes and new accounting standards.

Culture in Private Accounting

In contrast to the bustling world of public accounting, private accounting offers a more structured and stable environment. Accountants in this sector work for a single organization, embedding themselves in the corporate culture. Key aspects include:

- Work-Life Balance: Private accountants usually work standard office hours with limited travel, making it easier to balance both professional and personal commitments.

- Specialization: Private accountants develop specialized knowledge related to their industry, allowing them to offer deeper insights and support to management in financial decision-making.

- Independent Work: Many tasks are performed independently, requiring self-motivation and attention to detail. This can be appealing to those who prefer less direct supervision.

- Long-term Relationships: Building relationships within a single company creates a sense of belonging and stability, contributing to a more community-oriented atmosphere.

Overall, understanding these cultural differences can help aspiring accountants choose the path that aligns best with their career goals and personal preferences.

Regulatory Compliance

Understanding the regulatory frameworks that govern accounting practices is crucial for both public and private accountants. These regulations ensure accuracy, transparency, and ethical standards in financial reporting, which ultimately safeguards stakeholders’ interests.

Regulations in Public Accounting

Public accountants operate under a comprehensive set of regulations to uphold the integrity of their audits and financial reporting. Some key regulations include:

- Generally Accepted Accounting Principles (GAAP): Public accountants must adhere to these standards, which provide guidelines for financial reporting in the U.S. GAAP ensures consistency and comparability across financial statements.

- Securities and Exchange Commission (SEC) Regulations: For public companies, accountants must comply with SEC rules and regulations, including timely filing of financial reports.

- Public Company Accounting Oversight Board (PCAOB): This organization oversees the audits of public companies to protect investors and ensure impartiality. Public accountants conducting audits must follow PCAOB standards, which include strict auditing procedures.

- Sarbanes-Oxley Act (SOX): Enacted in response to corporate scandals, SOX mandates stricter compliance and internal controls for public companies, affecting how accountants report financial data.

Public accountants, particularly those aiming for CPA licensure, must stay updated on these regulations to provide compliant and reliable services.

Regulations in Private Accounting

Private accountants face a different landscape regarding regulatory compliance. While they are not subject to SEC regulations unless their company is publicly traded, they still must adhere to several important guidelines:

- Internal Controls: Private accountants implement and maintain internal controls to safeguard financial data and minimize fraud risks.

- GAAP Compliance: Like their public counterparts, private accountants follow GAAP for financial reporting, ensuring that their company’s financial statements are accurate and reliable.

- Industry-Specific Regulations: Depending on the sector, private accountants may need to comply with additional regulations specific to their industry, such as healthcare or finance laws.

Private accountants focus on compliance with internal policies and standards, ensuring the organization operates within legal frameworks. Adhering to these regulations fosters organizational integrity and conducive operational environments, driving the success of private enterprises. In conclusion, while both public and private accountants must navigate compliance landscapes, the specific regulations and their implications differ significantly between the two career paths. Understanding these requirements is essential for developing a successful career in accounting.