Understanding the cost of education is vital for any student considering studying abroad. Tuition fees can vary significantly based on the program and country. Students may encounter unexpected costs such as:

- Application fees

- Student service fees

- Enrollment fees

These expenses can quickly add up, making it essential to have a clear budget in place. For instance, a friend who studied in the UK found that fees were nearly double what he anticipated due to additional charges. A well-structured budget will help keep these costs in check.

Living Expenses

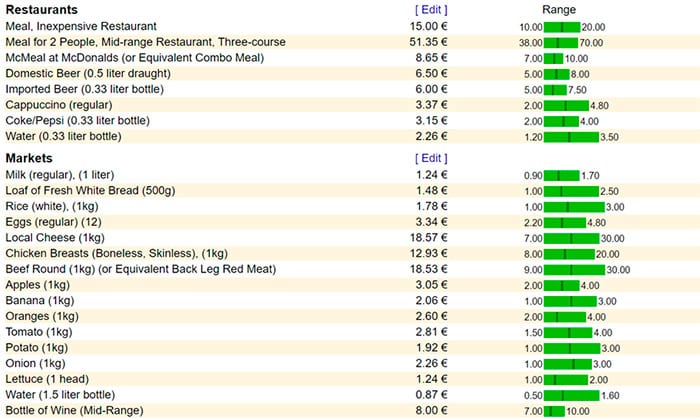

Once students calculate their educational costs, they must also factor in living expenses, which can substantially impact their overall budget. Essential living expenses to consider include:

- Rent (on or off-campus)

- Groceries

- Utilities (electricity, water, internet)

- Transportation

It’s useful to jot down average costs for these categories based on your destination. For example, while studying in a vibrant city can enhance your experience, it may also lead to higher living costs. Spending judiciously and managing these expenses can help students enjoy their study abroad adventure without financial stress.

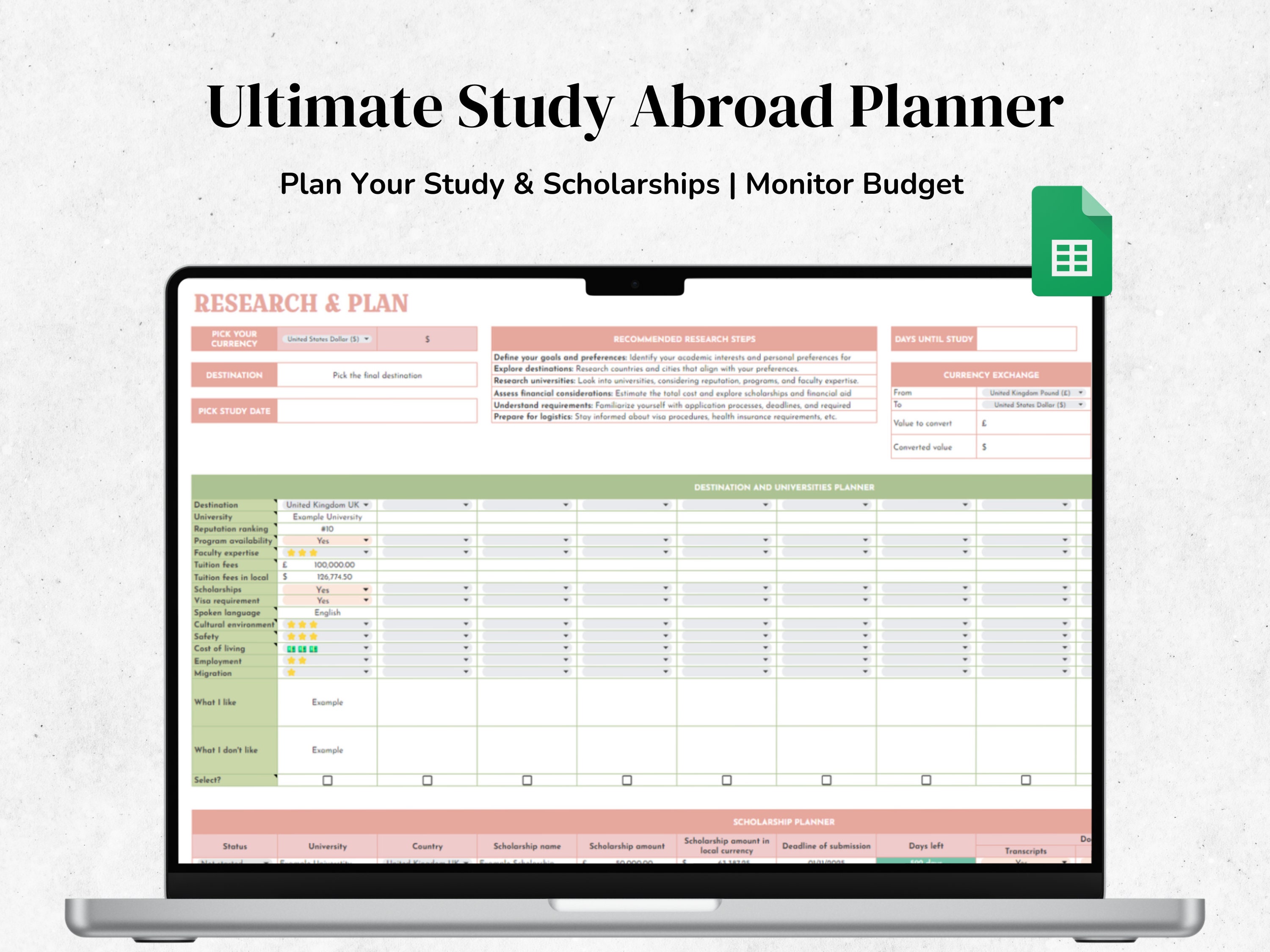

Researching Study Abroad Programs

Tuition Fees

When considering studying abroad, one of the first things to examine is the tuition fees associated with your program. These fees can differ dramatically based on:

- Country: Tuition often varies between nations.

- Program: Specialized programs may carry higher costs.

- University: Renowned institutions typically charge more.

For example, a friend who enrolled in a prestigious university in Australia was taken aback by the tuition fees. To avoid any financial surprises, it’s essential to gather detailed information about these costs from reliable sources and factor them into your overall budget.

Additional Costs

In addition to tuition, students must consider additional costs that can arise. These may include:

- Healthcare Costs: Health insurance is often mandatory and can add to expenses.

- Visa Fees: Understanding visa requirements and associated fees is crucial.

- Travel Insurance: This protects against unforeseen circumstances during your stay.

Compiling a list of these expenses can help create a comprehensive budget and ensure that students are financially prepared for their study abroad adventure. Remember, thorough research can save both money and hassle in the long run![3][4]

Setting Financial Goals

Savings Targets

Establishing savings targets is crucial in the process of preparing for studying abroad. It’s not just about knowing how much you need; it’s about creating an actionable plan. Start by identifying specific amounts to save each month based on your overall budget. For instance, if you aim to save $5,000 before departure, consider:

- Setting aside $500 monthly for 10 months.

- Cutting unnecessary expenses, like daily coffee runs or dining out.

Personal anecdotes demonstrate that a structured savings plan helps in achieving financial stability, turning once-unreachable dreams into reality.

Scholarship Opportunities

Another vital aspect of setting financial goals is exploring scholarship opportunities. Many institutions and organizations offer scholarships to ease the financial burden. Some tips to discover scholarships include:

- Researching university-specific scholarships.

- Visiting platforms dedicated to scholarship listings.

- Preparing strong applications early, including recommendation letters and essays.

One student I know secured a 50% scholarship by applying to multiple local and international sources, which significantly eased their financial stresses while abroad. It emphasizes the importance of proactive search and preparation![5][6]

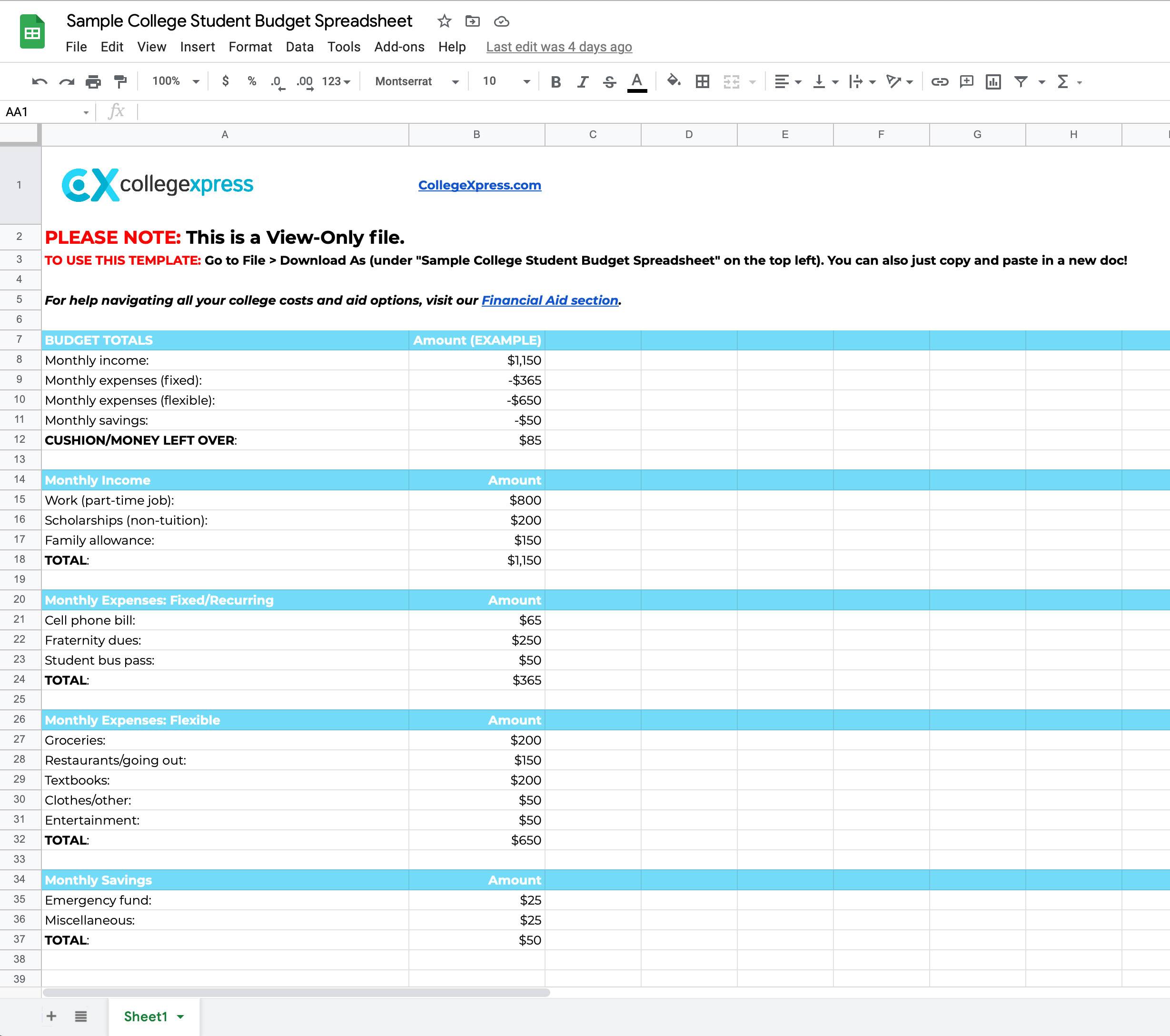

Creating a Detailed Budget Plan

Income Sources

To craft a comprehensive budget for your study abroad experience, it’s essential to identify income sources. These can vary widely, so consider:

- Personal Savings: Add up what you’ve saved so far.

- Family Contributions: Discuss with your family about any financial support they can offer.

- Scholarships and Grants: Research specific opportunities that might help cover your expenses.

For a friend, combining these sources made a significant difference in their ability to travel and enjoy their time studying in Spain.

Expense Categories

Next, it’s vital to define your expense categories clearly. A well-structured budget should include:

- Tuition Fees: The primary educational cost.

- Accommodation: Whether on-campus or off-campus, outline the costs.

- Food & Groceries: Consider how often you’ll eat out versus cooking at home.

- Transportation: Include public transport or fuel if you have a vehicle.

- Entertainment: Excessive costs can sneak up, so set limits here.

Breaking down expenses into categories provides clarity and can help in adjusting your budget as needed. A structured approach enables students to enjoy their abroad adventure without worrying too much about finances!

Tracking Expenses and Adjusting Budget

Keeping Receipts

A crucial part of managing your finances while studying abroad is keeping receipts. This practice not only helps track your spending but provides clarity on where your money goes. Here’s how you can do it effectively:

- Organize Receipts: Use a dedicated folder or app to store all your receipts digitally. This makes them easy to review at any time.

- Categorize Expenses: Group receipts by category like food, transportation, and entertainment.

A fellow student once shared how sorting her receipts weekly allowed her to spot extra spending on dining out and adjust accordingly.

Reviewing Spending Habits

Regularly reviewing your spending habits is essential to staying within budget. Here are some tips:

- Set a Weekly Review Time: Spend a few minutes each week examining your expenses.

- Identify Trends: Notice where you’re overspending or saving. For instance, if you’ve been frequently dining out rather than cooking, it might be time to reassess your food budget.

Adjusting your budget based on these insights can help students maintain financial control, ensuring that their study abroad experience remains enjoyable and stress-free.

Finding Part-Time Work Opportunities

Work-Visa Regulations

When considering part-time work while studying abroad, it’s imperative to understand work-visa regulations. Different countries have varying rules regarding how many hours a student can legally work. For instance, many student visas, like those in the UK or Australia, allow up to 20 hours of work per week during the semester.

- Check Visa Conditions: Always read the specifics of your visa to avoid any legal issues.

- Employer Restrictions: Some institutions may have partnerships with local businesses, simplifying employment for students.

A friend’s experience working part-time as a barista not only helped her with finances but also boosted her networking opportunities.

Balancing Work and Studies

Juggling a job and your studies can be challenging, but it’s not impossible. Here are some tips on balancing work and studies:

- Create a Schedule: Use planners or apps to allocate time for classes, study sessions, and work.

- Prioritize Tasks: Identify which tasks take longer, and complete those when you have less work.

My own experience showed that working on weekends gave me flexibility during the week to focus on studies without feeling overwhelmed. With thoughtful planning, you can make the most of your study abroad experience while managing both work and academics effectively!

Exploring Housing Options

On-Campus Housing

When it comes to finding housing while studying abroad, on-campus housing is often the most convenient option. Living on campus provides several benefits:

- Easy Access to Classes: You’re just a short walk away from your lectures.

- Social Opportunities: It’s a great way to meet fellow students and make friends.

- Amenities Included: Utilities and sometimes meal plans are included in the rent.

I remember a friend who stayed in a dorm during her semester in Australia. She enjoyed spontaneous study sessions and new friendships, making her experience even more enriching.

Off-Campus Rentals

Alternatively, off-campus rentals can offer more space and independence. Many students choose to live in the surrounding neighborhoods to:

- Save Money: Off-campus options can sometimes be cheaper than on-campus housing.

- Personal Preferences: You can select your own living arrangements, whether it’s a shared apartment or a private studio.

However, it’s essential to consider commuting time and transportation costs. For instance, a colleague found a fantastic apartment close to local eateries, providing her with a taste of the local culture while conveniently balancing her studies. Ultimately, whether you opt for on-campus or off-campus housing, make sure to choose what best suits your lifestyle and budget![13][14]

Managing Currency Exchange Rates

Exchange Rate Fluctuations

Understanding exchange rate fluctuations is crucial for maintaining your budget while studying abroad. These rates can change daily, impacting how much your money will stretch. For example, a sudden drop in your home currency can significantly raise your tuition and living expenses.

- Stay Informed: Regularly check exchange rates using reliable financial news sources or apps.

- Timing Matters: If possible, exchange your currency when rates are favorable, even if it means waiting a little longer.

A friend of mine saved hundreds by monitoring fluctuations and exchanging currency at the right time, making a big difference in her budgeting.

Using Student-friendly Banking Services

To make managing your finances easier, consider using student-friendly banking services. Many banks offer accounts specifically designed for international students, providing benefits such as:

- No Foreign Transaction Fees: Reduce the costs associated with using your home bank account abroad.

- Competitive Exchange Rates: Some banks provide better rates than traditional currency exchanges.

I remember opening a student account that offered fee waivers on withdrawals, which helped me allocate more of my budget to experiences rather than bank costs. Utilizing these banking services can make your study abroad experience smoother and more financially manageable!

Securing Health Insurance Coverage

Understanding Insurance Policies

When studying abroad, understanding health insurance policies is vital for your well-being. Many universities require students to have health coverage, and it’s essential to know what’s included. Look out for:

- Emergency Medical Coverage: Ensure the policy covers unforeseen injuries or illnesses.

- Repatriation of Remains: This benefit helps cover costs if something tragic happens abroad.

A friend once faced hefty medical bills because she didn’t understand her policy’s limitations, emphasizing the need for thorough comprehension before leaving.

International Health Coverage Options

While studying overseas, you can explore various international health coverage options. Consider:

- University-Sponsored Plans: Many institutions offer insurance tailored for international students.

- Independent Plans: Companies like WorldTrips or Atlas Travel provide comprehensive coverage for students abroad.

Utilizing these resources can give students peace of mind, allowing them to focus on their studies and experiences rather than worrying about potential medical emergencies!

Preparing for Unexpected Expenses

Emergency Fund Importance

Having an emergency fund is crucial for navigating the uncertainties of studying abroad. Life can be unpredictable, and setting aside a financial cushion will help you tackle unexpected expenses without derailing your budget.

- Aim for at least $500 to $1,000: This buffer can cover unforeseen costs like medical emergencies or flight cancellations.

- Contribute regularly: Even small, consistent savings can build a solid fund over time.

A fellow student shared how her emergency fund saved her during an unexpected medical visit, allowing her to focus on recovery instead of stress.

Dealing with Unforeseen Costs

Unexpected costs can arise anytime, so it’s essential to have a strategy for dealing with unforeseen expenses. Here are some tips:

- Stay organized: Keep all receipts and document expenses to track where your money goes.

- Reassess your budget regularly: Adjust your spending categories as needed to accommodate unexpected costs.

When I studied abroad, unexpected travel expenses came up due to a missed flight. Thankfully, knowing how to adjust my budget made it easier to cover the costs without panic. Remember, being prepared can keep studies and adventures running smoothly!