The job market for accounting graduates is robust and expanding. With a bachelor’s degree in accounting, professionals can qualify for a range of entry-level positions such as bookkeeping, auditing, and accounting clerk roles. Moreover, the potential for career advancement is significant, especially for those pursuing professional certifications like CPA or CMA. As the demand for financial expertise grows across various sectors, job prospects remain strong, with a projected growth of 16% for financial manager positions over the next decade.

Skills Required for a Successful Accounting Career

To thrive in an accounting career, individuals need a combination of hard and soft skills. Key skills include:

- Attention to Detail: Accuracy is critical when preparing financial statements or conducting audits.

- Analytical Thinking: Accountants must analyze financial data to identify trends and determine organizational risks.

- Communication Skills: Strong verbal and written communication is essential for explaining complex financial matters to clients and colleagues.

- Proficiency in Accounting Software: Familiarity with tools such as QuickBooks and Excel is indispensable.

Personal experience in the field often reinforces these skills, showcasing their importance in daily tasks.[1][2]

Different Paths in the Accounting Field

Public Accounting

Choosing a career in public accounting allows individuals to work as external advisors for diverse clients. Public accountants often take on a variety of roles, from handling tax returns to conducting audits. The fast-paced environment cultivates a steep learning curve, as accountants are exposed to multiple industries and client challenges. Key characteristics of public accounting include:

- Diverse Clientele: Work with businesses across various sectors.

- Skill Development: Constantly advance skills through diverse tasks.

- Career Advancement: Typically requires CPA certification for career growth.

Many aspiring accountants find public accounting exhilarating due to the breadth of experiences it offers.

Corporate Accounting

On the other hand, corporate accounting focuses on the financial health of a single organization. Professionals in this field often experience a more stable work-life balance and predictable hours compared to their public accounting counterparts. Corporate accountants manage vital functions like budgeting, financial analysis, and internal auditing. Opportunities include:

- Internal Auditor: Assess compliance and efficiency within the organization.

- Management Accountant: Provide strategic recommendations to enhance financial performance.

- Finance Manager: Oversee investments and financial strategy implementation.

Personal preference drives the choice between public and corporate accounting, as each path suits different career aspirations and lifestyles.

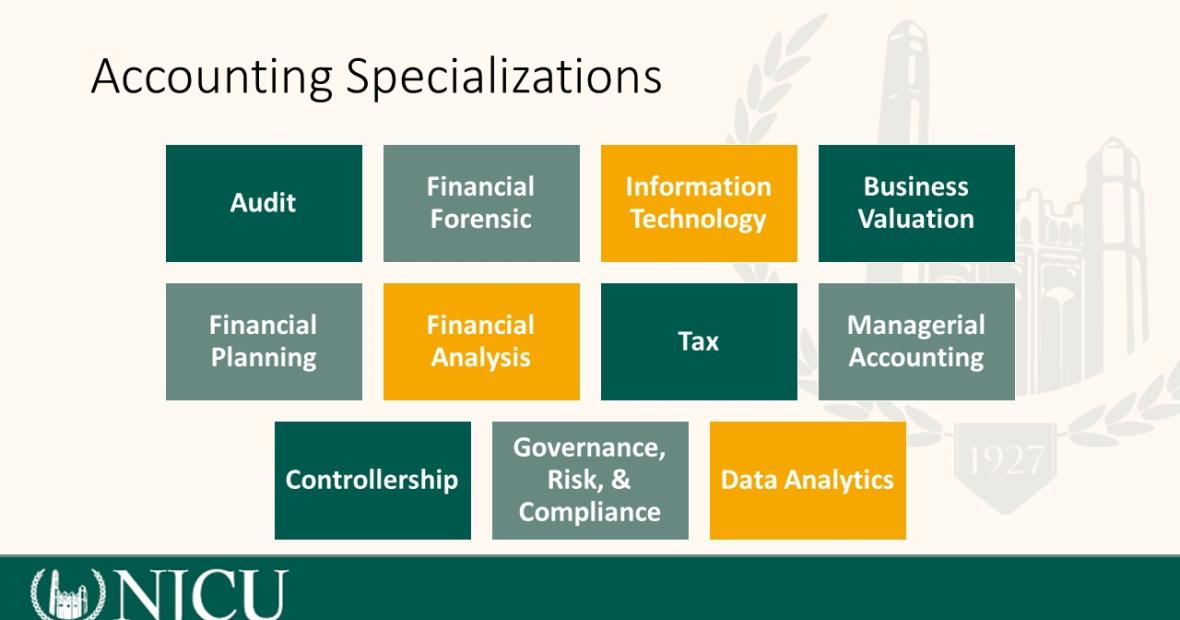

Accounting Specializations

Tax Accounting

Tax accounting is one of the most sought-after specializations in the accounting field. This niche focuses on the intricacies of tax laws and regulations, making it essential for businesses and individuals alike. Professionals can work as in-house accountants or for firms managing multiple clients. Key areas of focus include:

- Preparation of Tax Returns: Understanding the nuances of corporate, nonprofit, and personal tax filings.

- Regulatory Compliance: Keeping up with changing tax laws and ensuring adherence.

- Advisory Roles: Offering insights on tax-saving strategies and effective financial planning.

Tax accountants play a vital role in ensuring compliance and maximizing benefits for clients.

Forensic Accounting

Forensic accounting combines accounting, auditing, and investigative skills to uncover financial discrepancies and fraudulent activities. This specialization is essential for businesses wary of fraud and malfeasance. Professionals in this field often serve as expert witnesses during legal proceedings. In forensic accounting, you may engage in:

- Fraud Investigations: Analyzing financial records to detect anomalies and suspicious activities.

- Legal Support: Providing testimony in court cases related to financial mismanagement.

- Risk Assessment: Implementing strategies to prevent potential financial misconduct.

With the rise of financial crime, forensic accountants are becoming increasingly important, bringing their analytical skills to both the courtroom and corporate environment.

Professional Certifications in Accounting

Certified Public Accountant (CPA)

The Certified Public Accountant (CPA) is undoubtedly the most prestigious and recognized certification in the accounting field. Achieving this designation demonstrates a high level of expertise and commitment. To earn a CPA license, candidates typically need a bachelor’s degree in accounting, pass a rigorous four-part exam, and obtain at least one year of experience working in the field.

- Key Benefits of CPA:

- Career Opportunities: CPAs have access to a wider range of job options, including roles in auditing, taxation, and consulting.

- Credibility: Employers and clients trust CPAs for their advanced knowledge and ethical standards.

- Higher Earning Potential: CPAs often command higher salaries compared to non-certified professionals.

Many accountants find that becoming a CPA significantly enhances their career trajectory and professional reputation.

Certified Management Accountant (CMA)

The Certified Management Accountant (CMA) is another valuable certification, tailored for those focused on management accounting and financial management skills. To pursue this designation, candidates must hold a bachelor’s degree and have two years of relevant work experience. The CMA exam is divided into two parts, testing knowledge in areas such as financial planning, analysis, and control.

- Benefits of CMA:

- Strategic Acumen: CMAs are trained to make data-driven decisions that improve organizational performance.

- Versatile Skills: The emphasis on management accounting prepares professionals for leadership roles within companies.

- Networking Opportunities: Joining the CMA community opens doors to connections with other accounting professionals.

Professionals often find that CMA certification sets them apart in the competitive job market and enhances their ability to influence business strategy.

Advancement Opportunities in Accounting

Controller

Aspiring accountants often set their sights on the role of a Controller, a pivotal position in any organization. As a Controller, professionals are responsible for overseeing the entire accounting department, ensuring accurate financial reporting, and developing necessary internal controls. This role involves:

- Financial Oversight: Controllers manage all financial activities, including budgeting, forecasting, and compliance.

- Leadership: They lead teams of accountants and collaborate with other departments to align financial strategies with business goals.

- Risk Management: Controllers develop systems to mitigate financial risks, making their insights invaluable for organizational health.

For many, becoming a Controller is a significant milestone in their accounting career.

Chief Financial Officer (CFO)

Taking the next leap is transitioning to the role of Chief Financial Officer (CFO). As the top financial executive, a CFO plays a critical role in shaping a company’s financial strategy and direction. Responsibilities include:

- Strategic Planning: CFOs collaborate with other executives to develop long-term strategies that drive growth.

- Investor Relations: They manage communication with stakeholders and investors, presenting the company’s financial performance and outlook.

- Financial Leadership: CFOs not only oversee budgets and financial reports but also advise on critical business decisions.

This executive position often requires extensive experience and strong leadership skills, making it the pinnacle of an accounting career for many professionals.

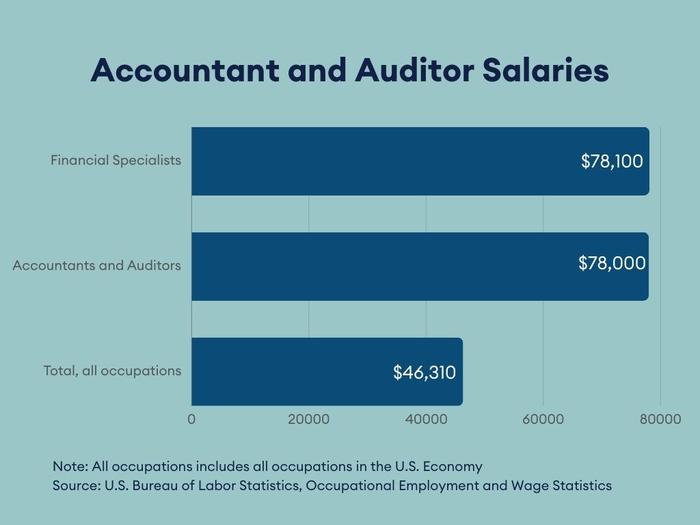

Salaries in the Accounting Field

Average Salaries for Entry-Level Accountants

Entering the accounting field can be lucrative, even at the entry-level stage. On average, entry-level accountants can expect to earn approximately $46,779 annually as accounting assistants. More specialized roles, such as financial accountants, offer starting salaries around $69,853. These figures can vary based on geographic location, industry, and the specific accounting duties involved. The salaries tend to increase with experience and advanced certifications, making accounting a promising career choice for new graduates.

Factors Influencing Accounting Salaries

Several factors impact what accountants earn, including:

- Location: Salaries in metropolitan areas are generally higher due to increased living costs.

- Experience: More experienced accountants tend to command higher salaries.

- Specialization: Those with certifications like CPA or CMA typically earn more.

- Industry: Accountants in finance or tech might see higher compensation than those in non-profit sectors.

Understanding these factors can help you plan your career and set realistic salary expectations.

Work-Life Balance in Accounting

Flexible Work Arrangements

One of the appealing aspects of many accounting positions today is the availability of flexible work arrangements. As businesses adapt to changing workforce dynamics, many accountants find themselves enjoying remote work options or hybrid schedules. For instance, some professionals work only 20-25 hours per week and spend part of their time at home, focusing on tasks at their own pace. This flexibility allows for a better work-life balance, enabling accountants to pursue personal interests or even manage family commitments alongside their careers.

- Remote Opportunities: Many firms now support fully remote roles or hybrid models.

- Flexible Hours: Some accountants can set their own hours, accommodating personal needs.

Busy Season Challenges and Solutions

While flexibility is abundant in many accounting roles, the busy season can pose significant challenges. During peak times, particularly tax season, accountants may find themselves working extended hours to meet deadlines. This is where effective time management and prioritization become essential. Solutions to manage busy periods include:

- Planning Ahead: Creating a detailed schedule beforehand can help navigate heavy workloads.

- Team Collaboration: Leaning on team members for support and delegating tasks can alleviate stress.

- Setting Boundaries: Clearly communicating your limits to supervisors can ensure you maintain a healthy work-life balance.

By implementing these strategies, accountants can help reduce the pressure during busy seasons while still delivering quality work.

Continuing Education in Accounting

Master’s in Accounting

Pursuing a Master’s in Accounting can be a significant step towards advancing your career. This degree not only deepens your knowledge of accounting principles but also enhances your expertise in specialized areas like auditing, tax, and financial analysis.

- Benefits of Earning a Master’s:

- Greater Earning Potential: Graduates often see substantial salary increases.

- Career Opportunities: Opens doors to higher-level positions such as Financial Controller or CFO.

- CPA Exam Preparation: Many programs provide excellent preparation for the CPA exam, making certification more attainable.

With a master’s degree, you position yourself as a competitive applicant in the job market.

Professional Development Courses

In addition to formal education, professional development courses are essential for staying current in the accounting field. These courses cover topics like new tax laws, regulatory changes, and emerging technologies in accounting.

- Advantages of Professional Development:

- Skill Enhancement: Keeps your knowledge up-to-date and relevant.

- Flexibility: Often available online, allowing you to learn at your own pace.

- Networking Opportunities: Connect with other professionals in the field.

Engaging in continuous education—through both advanced degrees and targeted courses—ensures you remain at the forefront of your profession, making a lasting impact in your career.

Networking and Building a Professional Reputation

Joining Accounting Associations

Joining accounting associations is a fantastic way to enhance your network and build credibility in the industry. Organizations such as the American Institute of Certified Public Accountants (AICPA) offer invaluable resources, including networking events, continuing education opportunities, and access to industry publications.

- Benefits of Membership:

- Networking Events: Meet peers, mentors, and potential employers at industry conferences.

- Resources: Gain access to exclusive industry insights and professional development resources.

Participating in these associations not only broadens your professional contacts but also adds weight to your resume.

Utilizing Social Media for Networking

In today’s digital age, social media platforms like LinkedIn are essential for networking. Engaging on these platforms allows you to connect with professionals across the globe, participate in discussions, and showcase your expertise.

- Effective Strategies:

- Optimize Your Profile: Keep your LinkedIn profile updated with relevant skills, certifications, and achievements.

- Join Groups and Participate: Engage in industry-specific discussions to demonstrate your knowledge and connect with like-minded professionals.

By strategically leveraging social media, you can expand your network and stay informed about industry trends, which is crucial for building a solid professional reputation.

Tips for Landing Your First Accounting Job

Crafting a Strong Resume

Your resume is the first impression you make on potential employers, so it’s crucial to craft it thoughtfully. Highlight relevant academic achievements, internships, and skills that align with the accounting role you’re pursuing.

- Key Elements to Include:

- Contact Information: Always keep it up-to-date.

- Objective Statement: A brief introduction that reflects your career goals.

- Education: List your degrees, relevant coursework, and any honors.

- Experience: Include internships and relevant project work, emphasizing your contribution.

- Skills: Highlight proficiency in accounting software and knowledge of GAAP.

A well-organized and tailored resume increases your chances of standing out in the competitive accounting job market.

Navigating the Job Interview Process

Once your resume has opened the door, it’s time to prepare for the interview. Understand the company and the specific role, and practice answers to common accounting interview questions.

- Preparation Tips:

- Research the Company: Know their mission, values, and industry position.

- Common Questions: Prepare to discuss your strengths and weaknesses, deadline management, and understanding of GAAP.

- Follow-Up: Always send a thank-you email expressing appreciation for the opportunity to interview.

Being well-prepared can make you feel more confident and leave a lasting impression on interviewers, paving the way for your first role in accounting.