Navigating the world of financial aid and student loans can be overwhelming for many students and their families. Understanding the various options available is crucial for a few key reasons:

- Reduces Financial Stress: Knowledge about financial aid can alleviate anxiety about funding education.

- Maximizes Opportunities: Familiarity with available resources helps families explore all potential aids, such as grants and scholarships.

- Avoids Debt Pitfalls: Awareness of loan types and their implications can prevent students from taking on excessive debt.

Students like Mia discovered the value of being informed when she successfully appealed for additional grants after learning about her eligibility.

Overview of Student Loan Options

When financial aid is insufficient to cover college costs, student loans become an essential resource. Broadly, student loans can be categorized into two types:

- Federal Student Loans: Offered by the government, these loans generally come with lower interest rates and more flexible repayment options.

- Private Student Loans: These loans stem from banks or private organizations, usually having stricter terms and higher interest rates.

Both options have distinct advantages, making it vital for students to explore their choices thoroughly.

Types of Student Loans

Federal Student Loans

Federal student loans are a reliable option for many students seeking financial assistance for college. These loans are provided directly by the government, which typically results in lower interest rates and better repayment terms.

- Direct Subsidized Loans: Available to students with demonstrated financial need. The government covers the interest while you’re in school, making this a smart initial choice.

- Direct Unsubsidized Loans: These loans are not based on financial need. Interest begins accruing immediately, so it is important to consider payment options.

When Sarah applied for college, she prioritized federal loans, which ultimately eased her financial burden significantly during her studies.

Private Student Loans

Private student loans should generally be a last resort, coming from banks or financial institutions once all federal options are exhausted. These loans can vary widely in terms, so do some research before applying.

- Interest Rates: These are often higher than federal loans and can be fixed or variable.

- Cosigner Requirement: Many private loans require a cosigner, especially for students without established credit.

John discovered that while private loans filled funding gaps, he faced higher payments and less flexibility compared to his federal loans. Understanding these differences is crucial for financially navigating college!

Eligibility Criteria for Financial Aid

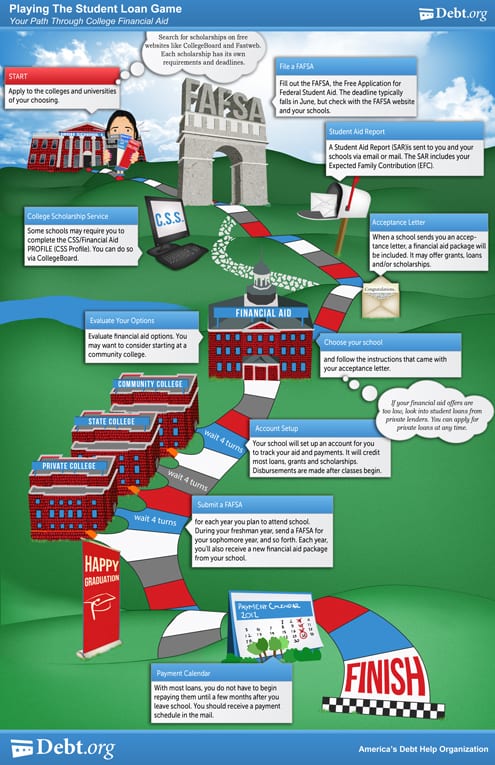

FAFSA Requirements

The Free Application for Federal Student Aid (FAFSA) is essential for any student seeking federal financial aid. Think of it as your ticket to unlock various funding opportunities. Here are some key points to remember:

- Important Deadlines: Submit your FAFSA as early as possible after October 1.

- Required Information: Include details about your family’s financial situation, including income and assets.

- Annual Submission: You must complete the FAFSA every year to maintain eligibility.

When Emma first filled out her FAFSA, she was surprised to find that she qualified for several grants and federal loans that eased her financial burden.

Scholarships and Grants

Scholarships and grants are fantastic forms of financial aid because they don’t require repayment! However, they come with certain eligibility requirements:

- Merit-Based Scholarships: Often awarded based on academic achievements, sports, or art. Students must maintain specific performance metrics.

- Need-Based Grants: These funds are typically awarded depending on your financial circumstances, such as income level or family size.

John, a high school senior, applied for several scholarships based on his academic performance and service activities, significantly reducing his college costs. Understanding the nuances of scholarships and grants can be a game-changer in your educational journey!

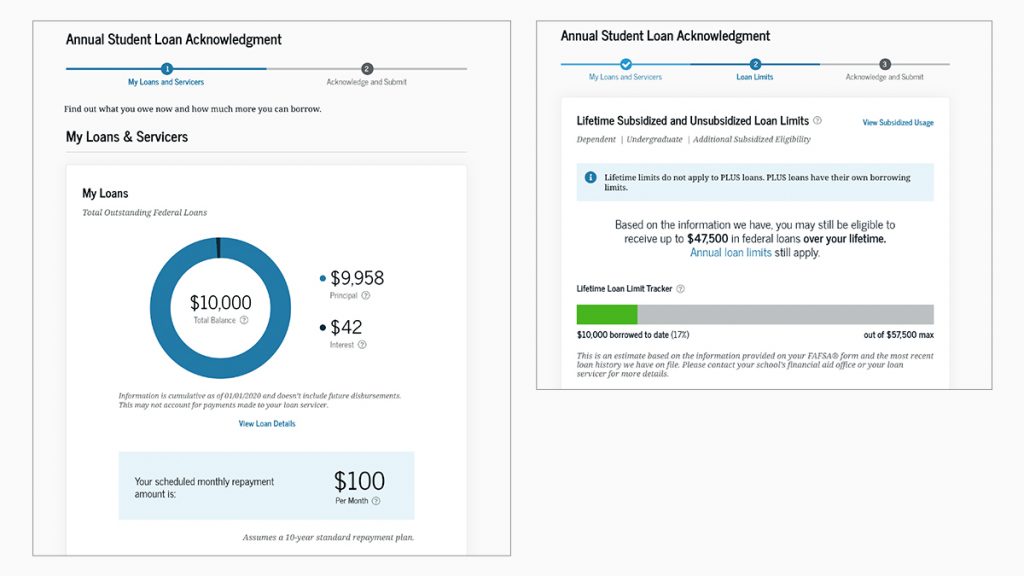

Managing Student Loan Debt

Loan Repayment Plans

Understanding your repayment options is crucial as you navigate student loan debt. There are several plans available that cater to different financial situations:

- Standard Repayment Plan: Fixed monthly payments over 10 years, making it straightforward but may be challenging if income is low.

- Income-Driven Repayment Plans: Payments are based on income and family size, capping them at a percentage of your discretionary income, ideal for those on tighter budgets.

- Graduated Repayment: Payments start low and gradually increase every two years, which offers a manageable way to start.

When Alex graduated, he chose an income-driven plan, which allowed him to comfortably balance his living expenses and loan payments until his salary increased.

Loan Forgiveness Programs

Loan forgiveness programs can be a beacon of hope for many graduates. These programs are designed to alleviate the burden of student loans under certain conditions:

- Public Service Loan Forgiveness (PSLF): Available to those working in qualifying public service jobs. After 120 qualifying payments, borrowers may have their loans forgiven.

- Teacher Loan Forgiveness: Teachers who work in low-income schools for a set number of years may qualify for forgiveness.

Maria, a dedicated teacher, eagerly applied to PSLF after several years in her role, hopeful that her hard work would lead to financial relief. Exploring these options can significantly lessen the impact of student debt on your financial future!

Exploring Alternative Financing Options

Work-Study Programs

Work-study programs provide an excellent opportunity for students to earn money while pursuing their education. These programs often allow students to work part-time, typically on campus, helping to cover tuition and living expenses. Here are some benefits:

- Flexibility: Work hours can often be arranged around your class schedule.

- Job Experience: Gaining work experience in your field can enhance your resume and professional skills.

For instance, when Emily participated in her university’s work-study program, she not only earned money for her books but also built connections in her chosen field, setting her up for future internships.

Crowdfunding for Education

Crowdfunding has become a popular tool for students seeking financial help for their education. It allows individuals to reach out to friends, family, and even strangers through platforms like GoFundMe or Kickstarter. Here’s how it works:

- Create a Campaign: Outline your goals, tuition costs, and why financial support is needed.

- Share Your Story: Engaging stories and personal connections can attract potential donors.

Alex opted for crowdfunding to cover the gap in his budget for studying abroad. His heartfelt story resonated with many, and he successfully raised the funds he needed. Exploring these alternative options can significantly ease your financial burdens!

Tips for Maximizing Financial Aid

Understanding EFC

The Expected Family Contribution (EFC) plays a crucial role in determining your eligibility for financial aid. It’s essentially a measure of your family’s financial strength when applying for aid through the FAFSA. Here’s how you can understand and possibly influence it:

- Keep Income Low: Strategies like postponing sales of profitable stocks can keep your reported income within a lower bracket.

- Asset Considerations: Save in parent-owned accounts rather than student accounts to reduce the EFC.

When Mia’s family adjusted their income reporting, their EFC dropped significantly, increasing their financial aid prospects.

Appealing Financial Aid Decisions

If your financial aid offer doesn’t meet your needs, don’t hesitate to appeal! Many students successfully navigate this process. Here are tips to strengthen your appeal:

- Gather Documentation: Prepare evidence of special circumstances like a job loss or medical expenses.

- Communicate Clearly: Write a concise letter detailing your situation and request a professional judgment review.

After John appealed his financial aid package, he received additional funding that helped him cover his tuition. Being proactive can lead to improved financial support!

Common Misconceptions about Student Loans

Impact on Credit Score

Many borrowers underestimate how student loans can affect their credit score. It’s essential to remember that loans are a form of credit, and timely payments can help build your score. Conversely, missing payments can cause significant damage. Here’s what to keep in mind:

- Payment History Matters: Your payment history comprises about 35% of your credit score, so consistency is key.

- Credit Utilization: High balances can negatively impact your score, even if they’re not on credit cards.

When Lisa graduated, she diligently made her payments, which helped raise her credit score, proving that responsible management of student loans can lead to financial health down the line.

Bankruptcy and Student Loans

The idea that filing for bankruptcy can wipe out student loan debt is a dangerous misconception. In most cases, student loans are non-dischargeable debts, meaning they can’t be eliminated through bankruptcy. Here are some alternatives to consider:

- Forbearance or Deferment: These options allow you to temporarily pause payments without the drastic step of declaring bankruptcy.

- Repayment Plans: Income-driven repayment plans can make payments manageable based on your financial situation.

James found himself struggling to pay his student loans and initially thought about bankruptcy. However, after exploring options like deferment, he was able to manage his payments without ruining his financial future. Understanding these realities is vital for effective student loan management!

Resources for Financial Aid Assistance

Student Loan Counselors

Navigating the complexities of student loans can be daunting, but student loan counselors are here to help! These professionals provide personalized guidance tailored to individual financial situations. Here’s how they can assist:

- One-on-One Counseling: Counselors can help you understand your loan options and repayment plans.

- Budgeting Help: They can work with you to create a budget that accommodates your loan payments alongside other expenses.

When Sarah felt overwhelmed by her student loans, a counselor helped her clarify her repayment options, leading to a manageable plan that eased her anxiety and set her on the right path.

Financial Literacy Workshops

Financial literacy workshops are excellent resources for students looking to improve their understanding of personal finance, including student loans. These workshops typically cover:

- Budgeting Basics: How to effectively allocate your income.

- Debt Management: Strategies for managing loans and credit effectively.

John attended a financial literacy workshop during college, which equipped him with vital tools for budgeting, making him more confident in managing his student debt. Utilizing these resources can transform your approach to finance and set you up for success!