Studying abroad can be one of the most enriching experiences for a student, offering a chance to immerse oneself in diverse cultures and broaden educational horizons. However, understanding the costs involved is essential for effective financial planning.

Tuition Fees and Scholarships

Tuition fees are often one of the largest expenses when studying abroad. Depending on the country and institution, fees can range significantly. For example, studying in the U.S. might average around $30,000 per year, while university fees in countries like Germany or Finland could be much lower, often around $1,000 to $5,000 for non-EU students. Tuition Fee Breakdown:

- Public Universities: $10,000 – $40,000 per year (U.S.)

- Private Universities: $20,000 – $50,000 per year (U.S.)

- European Universities: $1,000 – $5,000 per year (varies by country)

Students should consider applying for scholarships and grants as a way to mitigate these costs. Many universities and organizations provide partial or full funding based on academic excellence, financial need, or specific demographics. In fact, conducting thorough research on available scholarships can lead students to financial assistance that might significantly lessen their burden.

Living Expenses and Other Financial Considerations

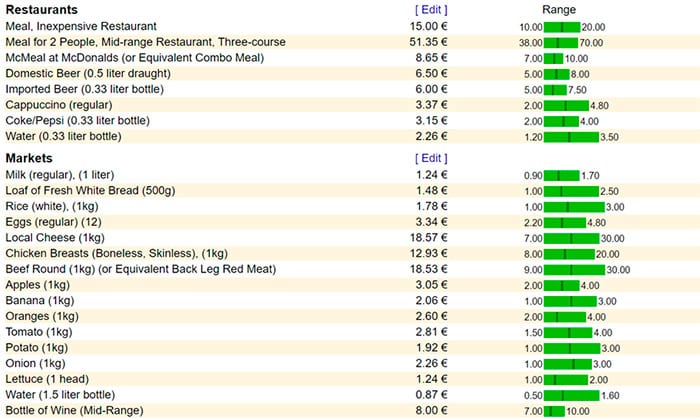

Apart from tuition, living expenses can greatly impact a student’s budget. The cost of living can vary dramatically based on the city or country, so it’s crucial to factor these costs into your budget. Cities like New York or London will typically have higher living expenses compared to smaller towns or cities in Eastern Europe. Common Living Expenses:

- Accommodation:

- On-campus housing: $500 – $1,500 per month

- Off-campus rentals: $700 – $2,500 per month (depending on the location)

- Food: $200 – $600 per month

- Transportation: $100 – $200 per month

- Miscellaneous: Including personal items, healthcare, and entertainment, typically around $100 – $300 per month.

Total Monthly Estimate: Ranges from $1,000 to $3,500 depending on location and lifestyle. To navigate these costs effectively, students should create a detailed budget plan. Validating all potential monthly expenses will enable students to save where possible, ensuring they can focus on their studies and enjoy their time abroad. Understanding these essential financial aspects empowers students to pursue their overseas education dream while maintaining control over their spending.[1][2]

Researching Your Options for Funding

After understanding the costs associated with studying abroad, the next step is to delve into the numerous funding options available. This involves exploring government grants, private loans, and sponsorships. By thoroughly researching these avenues, students can alleviate some of the financial pressure associated with their overseas education.

Government Grants and Funding Programs

Government grants can be a fantastic way to reduce education costs, as they often do not require repayment. Countries, states, and local governments frequently offer programs aimed at helping students afford the expenses of studying abroad. Here are a few examples:

- Federal and State Grants (U.S.): Many U.S. states offer grants to help students study abroad. This includes programs like the Federal Pell Grant, which can provide significant amounts of funding based on financial need.

- International Programs: Some countries have their own initiatives, such as the Erasmus+ program in Europe, which provides funding for students studying in EU member states.

- Specialized Funds: Certain governments may offer funding targeted at specific fields of study or cultural exchange programs.

Students should regularly check their home country’s educational department website for available grants and eligibility criteria. Applying early and paying attention to deadlines can significantly increase the chances of securing funding.

Private Loans and Sponsorships

While government grants are invaluable, they may not cover all expenses, leading many students to consider private loans or sponsorships.

- Private Loans:Most banks and financial institutions offer loans specifically designed for educational purposes. Key points to consider include:

- Types of Loans: Federal loans are typically lower interest than private loans, but as international students may not qualify for federal loans in certain countries, they must rely on private ones.

- Repayment Plans: Understanding the repayment terms is crucial—some loans may start accruing interest while you study.

- Sponsorships:Corporate sponsorships can be a great way to finance studies. Many companies look for talented students to sponsor in exchange for future employment or internships. Here’s how to pursue sponsorships:

- Networking: Attend career fairs and engage with potential sponsors during university events.

- Tailored Proposals: Create a compelling proposal detailing your academic achievements, career goals, and what you can bring to the organization.

Both paths—private loans and sponsorships—have their merits, and students must weigh their options carefully. By tapping into different funding sources, students can ensure they are well-equipped financially to embark on their study abroad adventures.

Creating a Detailed Budget Plan

Once students have navigated through the financial avenues available to fund their study abroad experience, the next crucial step is creating a detailed budget plan. This can make all the difference between enjoying the experience and fretting over finances.

Tracking Expenses and Setting Priorities

The first step in budgeting is to get a clear understanding of your expected expenses. Taking the time to track these expenses can help identify where your money is going and where adjustments need to be made. Tips for Tracking Expenses:

- Use Budgeting Apps: Consider downloading budgeting apps like Mint or YNAB (You Need A Budget) that can help track spending automatically.

- Daily Expense Log: Keep a simple notebook or digital note on your phone to jot down all expenditures. This can reveal surprising patterns and highlight areas for potential savings.

Set Spending Priorities:

- Necessities Over Luxuries: Always prioritize necessities (rent, groceries, tuition) over luxuries (dining out, entertainment) in your budget.

- Establish a Spending Limit:Determine a realistic spending cap for each category to avoid overspending. For example:

- Food: $200/month

- Transportation: $100/month

- Entertainment: $50/month

Allocating Funds for Various Needs

With a clearer picture of your financial landscape, the next step is to allocate funds to different categories effectively. This structured approach ensures that essential aspects of your study abroad experience are adequately financed. Essential Categories to Consider:

- Tuition Fees: Always allocate funds for tuition payments first.

- Accommodation: Estimate rent based on your chosen living arrangement.

- Utilities and Internet: Include these as recurring weekly or monthly expenses.

- Food and Groceries: Create a meal plan to better estimate grocery costs and meal preparation.

- Transportation: Research local transport options; consider monthly passes if available to save costs.

- Study Materials: Account for books and other supplies necessary for courses. These might appear expensive, but buying second-hand or digital versions can help trim costs.

- Emergency Fund: Set aside a small percentage (about 5-10%) of your budget for unforeseen emergencies, ensuring that a financial hiccup doesn’t derail your plans.

By creating a comprehensive budget, tracking expenses diligently, and allocating funds wisely, students can navigate their study abroad journey with financial confidence. This careful planning allows for a rich and fulfilling experience abroad without the cloud of financial stress.

Saving Money as an International Student

Studying abroad can be a thrilling adventure filled with opportunities, but managing finances can be a daunting task. Fortunately, there are numerous ways for international students to save money while still enjoying their experience. Two crucial aspects of saving money include finding part-time job opportunities and implementing smart money-saving tips.

Part-Time Jobs and Internship Opportunities

One of the most effective ways to save money while studying abroad is to seek part-time employment. Many countries permit international students to work, allowing them to earn extra income while gaining valuable experience. Benefits of Part-Time Work:

- Financial Independence: A part-time job can significantly ease financial burdens, contributing directly to living expenses, tuition, or travel.

- Networking Opportunities: Working allows students to build connections in their host country, enhancing their social and professional networks.

- Flexible Schedules: Many jobs cater to student schedules, with options to work evenings or weekends. Roles such as tutoring, café work, or retail positions often provide the flexibility students need.

Internship Opportunities: Internships can be another excellent avenue for students, especially if they align with their field of study. Not only do internships provide valuable experience, but they can also sometimes be paid, offering a financial boost to a student’s budget.

Money-Saving Tips and Resources

In addition to finding work, international students can employ various strategies to stretch their budgets further. Here are some practical tips: Budget Wisely:

- Create a budget that outlines expected expenses, and track spending regularly using budgeting apps like Mint or YNAB. This practice helps pinpoint unnecessary expenditures.

Use Student Discounts:

- Many businesses offer discounts for students. Always carry your student ID to enjoy savings on transport, dining, and cultural events.

Cook at Home:

- Eating out can drain funds quickly. Cooking meals at home is often not only healthier but also significantly more economical. Preparing larger portions and using leftovers can also minimize food waste.

Embrace Thrifting:

- Shopping at thrift stores or buying second-hand items can save a substantial amount on clothing and books. Websites like Depop or Vinted offer platforms for finding quality pre-owned items.

Utilize University Resources:

- Many universities provide free resources, including financial advice, workshops, and even access to funds or scholarships. Engaging with these services can open doors to savings and financial management tips.

By leveraging part-time job opportunities and implementing money-saving strategies, international students can enjoy their time abroad while keeping their finances in check. A little planning goes a long way in ensuring that students have the best of both worlds: rich experiences without the financial stress.

Seeking Financial Guidance and Support

Navigating the financial landscape of studying abroad can be overwhelming, but seeking financial guidance and support is a crucial step. Leveraging expert advice and utilizing available university resources can significantly ease the financial burden and help students plan effectively.

Consulting Financial Advisors and Counselors

One of the best steps international students can take is to consult with financial advisors or counselors. Many universities offer these services, often included as part of enrollment. Here are a few reasons why using financial advisors is beneficial:

- Personalized Financial Planning: A financial advisor can help tailor a budget that fits individual needs. They take into account tuition fees, living expenses, and personal savings to create a realistic financial plan.

- Understanding Financial Aid: Advisors can clarify the intricacies of financial aid options, including scholarships, grants, and student loans. They can guide students on how to apply for these opportunities effectively.

- Balancing Work and Study: Financial counselors can provide insights on managing part-time work alongside studies, ensuring students maintain a healthy balance without compromising academic performance.

For instance, a friend of mine, an international student in Australia, consulted a financial counselor who helped her set up a budget plan that allowed her to save for traveling while ensuring she had enough for her tuition and living expenses.

Utilizing University Resources and Services

Universities often provide a wealth of resources specifically designed to support students financially. Students should take full advantage of these services, which can range from workshops to online resources:

- Scholarship Opportunities: Many universities maintain a database of scholarships, both internal and external. Regularly checking this database can unearth new funding opportunities.

- Financial Workshops: Participating in financial literacy workshops can better equip students with the skills needed to manage their finances effectively. These workshops cover budgeting, savings strategies, and even investment basics.

- Student Unions: Student unions often have dedicated staff to assist with financial inquiries and can provide resources for budgeting tips, part-time job listings, and local financial support services.

Engaging with these resources not only helps students manage their finances but also fosters a sense of community and support within the university. Remember, being proactive in seeking financial guidance can lead to a more enriching and less stressful study abroad experience!