Student loans can feel like an insurmountable burden for many graduates, often leading to stress and financial strain. However, there are effective strategies to tackle this debt efficiently and regain control over one’s finances.

Why This Matters

Navigating the labyrinth of repayment options and financial plans can be daunting, but understanding the process is essential. For instance, making extra payments or choosing a shorter repayment term can drastically reduce both the repayment period and the overall interest paid. Here are some key considerations:

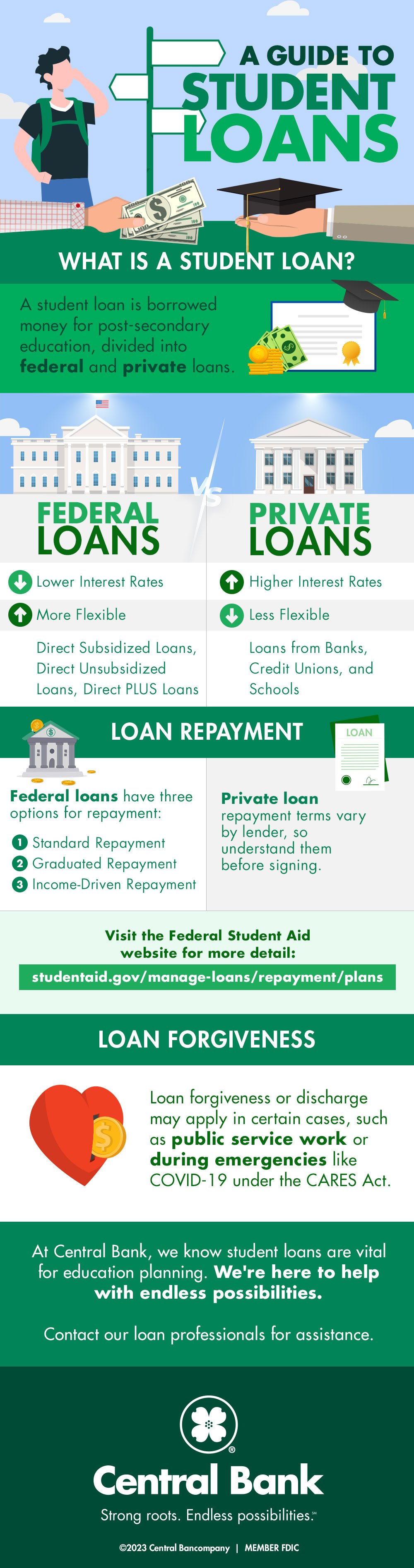

- Know Your Loans: Identify whether they are federal or private.

- Create a Strategy: Establish a personalized repayment plan.

- Stay Informed: Keep abreast of any changes in legislation that could affect your loans.

By approaching student loans with a clear plan, individuals can make strides towards financial freedom.

Understanding Student Loans

Navigating the world of student loans can be confusing, but having a clear grasp of their types and how interest accumulates makes a significant difference in repayment strategies.

Types of Student Loans

There are primarily two categories of student loans: federal and private.

- Federal Student Loans: These loans are offered by the government and usually come with fixed interest rates and more flexible repayment options.

- Private Student Loans: These loans are offered by banks and financial institutions, often requiring a credit check. They may have variable rates and fewer repayment options.

How Interest Accumulates

Understanding interest accumulation is crucial. With federal loans, interest starts accruing while you’re in school for most loan types. For private loans, interest can accrue immediately.

- Capitalized Interest: This occurs when unpaid interest gets added to the principal balance, increasing the total amount due. For instance, if a student loan accrues interest during a grace period, that amount can significantly inflate the loan balance.

By staying informed about these aspects, borrowers can make better decisions on managing and eventually repaying their loans.

Create a Repayment Strategy

Once a borrower understands their student loans, creating a tailored repayment strategy is crucial for effective debt management. This approach can significantly ease the repayment process.

Setting a Budget

Start by establishing a monthly budget that aligns with personal income and expenses. This helps in identifying how much can be allocated towards loan payments. Consider:

- Reviewing Monthly Expenses: List all current expenditures to uncover potential savings.

- Creating Spending Limits: Set limits on discretionary spending to free up funds for loans.

- Using Budgeting Tools: Utilize apps or spreadsheets to track and adjust your spending habits.

Exploring Repayment Plans

Next, explore various repayment plans available for federal and private loans. It’s essential to find a plan that best suits financial circumstances, such as:

- Standard Repayment Plan: Fixed monthly payments over a 10-year period, often leading to less interest paid over time.

- Income-Driven Repayment Plans: Payments based on income, allowing for lower monthly costs but potentially extending the repayment duration.

By committing to a budget and understanding repayment options, borrowers can manage their student loans more effectively and avoid unnecessary financial strain.

Increase Income Opportunities

Improving income is a practical approach to accelerate student loan repayment. By harnessing additional income sources, borrowers can allocate more funds towards their loans, reducing the burden significantly.

Side Hustles

Side hustles are a popular way to earn extra cash without committing to full-time hours. Consider options that fit your lifestyle, such as:

- Tutoring: If you excel in a particular subject, online tutoring can be lucrative.

- Rideshare Driving: Companies like Uber or Lyft offer flexible hours.

- Pet Sitting or Dog Walking: Many animal lovers find joy in these roles, plus they pay well!

Each little bit helps, and side hustles can boost your income substantially over time.

Freelancing Opportunities

Freelancing allows you to monetize your skills while managing your time effectively. Here are some avenues to explore:

- Writing or Blogging: Many businesses need content; if you have a knack for writing, this could be your avenue.

- Graphic Design: Utilize platforms like Canva or Adobe to create marketing materials for businesses.

- Social Media Management: Help small businesses enhance their online presence by managing their social media accounts.

By tapping into side gigs or freelancing, you can create a more sustainable financial situation and make a significant dent in your student loans.

Utilize Employer Benefits

Leveraging employer benefits can significantly ease the financial burden of student loans. Many companies recognize the growing student debt crisis and have developed programs to support their employees.

Loan Repayment Assistance Programs

Many employers now offer Loan Repayment Assistance Programs (LRAPs) as part of their benefits package. These programs may provide:

- Direct Contributions: Employers can contribute monthly amounts to help pay down your loan balance.

- Tax-Free Assistance: Under current tax laws, contributions are not considered taxable income, making this an attractive benefit.

For instance, you can check with your HR department to see if your employer offers such programs and to what extent, possibly adding hundreds of dollars toward your loans annually.

Public Service Loan Forgiveness

If you work in qualifying public service jobs, you may benefit from the Public Service Loan Forgiveness (PSLF) program. Here’s what you need to know:

- Qualifying Employment: Only employment with government or non-profit organizations counts toward forgiveness.

- Eligibility Criteria: After making 120 qualifying monthly payments, borrowers can have their remaining balance forgiven tax-free.

Taking advantage of these employer benefits can boost your financial health and expedite your journey to becoming debt-free. Don’t hesitate to explore what your employer can offer!

Refinance or Consolidate Loans

Navigating the options for refinancing and consolidating student loans can significantly impact a borrower’s financial journey. Understanding the benefits and drawbacks can help in making an informed decision.

Pros and Cons of Refinancing

Refinancing involves replacing your current loans with a new loan, often at a lower interest rate. Here are some pros and cons: Pros:

- Lower Interest Rates: If you qualify, you may save a significant amount over the life of the loan.

- Reduced Monthly Payments: Lower rates can decrease the financial burden each month.

Cons:

- Loss of Federal Benefits: Refinancing federal loans means losing access to programs like income-driven repayment and loan forgiveness.

- Credit Requirements: A good credit score and steady income are often necessary to secure favorable rates.

Understanding Loan Consolidation

Loan consolidation combines multiple federal loans into one through a Direct Consolidation Loan. Here’s what to know:

- Simplified Payments: It consolidates all loans into a single monthly payment, making budgeting easier.

- Interest Rate: The new interest rate is a weighted average of existing loans, rounded up, which might not always reduce your costs.

While consolidation can streamline payments, it doesn’t necessarily reduce the total interest paid, making it essential to weigh your options carefully.

Avoid Default

Avoiding default on student loans is crucial for maintaining financial stability. Defaulting not only affects your credit score but can lead to serious long-term consequences.

Consequences of Default

Falling into default can have significant repercussions, such as:

- Credit Damage: Your credit score can plummet, making it difficult to secure future loans or credit.

- Wage Garnishment: Loan holders can legally take a portion of your paycheck to recover the debt.

- Loss of Benefits: You may lose access to various repayment plans, deferment options, and even public service loan forgiveness.

Options for Delinquent Loans

If you find yourself missing payments or falling behind, don’t panic. Here are options to consider:

- Act Quickly: Contact your loan servicer immediately to discuss your situation and explore solutions.

- Repayment Plans: Consider enrolling in an income-driven repayment plan to lower your monthly obligations.

- Loan Rehabilitation: Federal loans may qualify for a rehabilitation program, allowing you to restore your account status after making a series of payments.

By staying proactive and informed, you can avoid default and maintain control over your student loans.

Apply for Loan Forgiveness

Navigating the world of student loan forgiveness can provide substantial relief for borrowers, especially those in public service positions or educational roles.

Teacher Loan Forgiveness

If you’re a teacher working in a low-income school, you might be eligible for the Teacher Loan Forgiveness program. Here are the key points:

- Eligibility: Teach full-time for five consecutive years in an eligible school.

- Loan Relief: You could receive up to $17,500 in forgiveness for certain federal loans.

This program can make a significant difference in managing educational debt while pursuing a rewarding career.

Federal Loan Forgiveness Programs

In addition to teacher-specific programs, the federal government offers broader Loan Forgiveness options, such as:

- Public Service Loan Forgiveness (PSLF): After making 120 qualifying payments while working for a government or nonprofit employer, you may have your remaining balance forgiven.

- Income-Driven Repayment Forgiveness: Borrowers may receive forgiveness on their remaining balance after 20-25 years of repayment under an income-driven plan.

By taking advantage of these forgiveness options, borrowers can make strides toward long-term financial freedom. Exploring eligibility and keeping track of requirements is vital to success!

:max_bytes(150000):strip_icc()/how-do-i-make-extra-payments-on-my-loans-2385993-Final-5eb31629b3764eb7a3a55a8bd2599da8.jpg)

Make Extra Payments

Making extra payments on student loans can fast-track your path to financial freedom. Understanding strategies like the snowball and avalanche methods can help determine the best approach.

Snowball vs. Avalanche Method

- Snowball Method: Focuses on paying off the smallest debt first. Once cleared, you redirect those payments to the next smallest loan. This can build momentum and motivation.

- Avalanche Method: Prioritizes loans with the highest interest rates, which can save you more money on interest over time.

Both methods have their benefits and can be effective depending on your financial situation and psychological preference.

Benefits of Making Extra Payments

Making extra payments can lead to:

- Reduced Interest Costs: By paying down your principal faster, you minimize the amount of interest that accrues.

- Shorter Loan Terms: You may pay off loans years earlier, freeing up cash flow for other financial goals.

For instance, consistently adding just $50 more a month can significantly reduce the lifespan of your loan. This small change can make a big difference!

Keep Track of Progress

Tracking your progress in paying off student loans can enhance motivation and keep your financial goals in focus. Here are a couple of strategies to help you stay on top of your repayment journey.

Loan Tracking Tools

Utilizing loan tracking tools can help monitor your balances and payments effectively. Consider these options:

- Financial Apps: Many apps allow you to track payments, interest accumulation, and overall loan balance.

- Spreadsheets: A simple spreadsheet can help record payments and visualize your repayment strategy.

These tools can provide a clear perspective on your progress and help plan for the future.

Celebrating Milestones

Don’t forget to celebrate your milestones, no matter how small! Acknowledging when you:

- Pay off a specific loan

- Reach a certain percentage paid off

can serve as motivation. Treat yourself to a little reward or do something enjoyable. Keeping a positive outlook throughout the repayment process will help maintain momentum!

Seek Assistance

If you’re feeling overwhelmed by student loan repayment, seeking assistance can provide clarity and options tailored to your situation. Don’t hesitate to reach out for guidance!

Contacting Loan Servicers

Your loan servicer is your primary resource for questions about your loans. Here’s how to approach them:

- Clarify Your Balance: Confirm your total loan amount and payment terms.

- Ask About Options: Inquire about repayment plans, deferment, or forbearance options if you’re facing difficulties.

Building a rapport with your servicer can greatly enhance communication and responsiveness.

Seeking Help from Financial Advisors

Consider getting advice from a financial advisor, especially one who specializes in student loans or debt management. They can:

- Create Customized Plans: Help you strategize on budgeting and repayment to maximize efficiency.

- Offer Resources: Provide insights on potential relief options, including refinancing or loan forgiveness programs.

Utilizing professional help can pave the way to a more manageable repayment process, making your financial goals more achievable.

Consider Income-Driven Repayment

Income-driven repayment (IDR) plans offer a viable option for borrowers struggling to meet standard payment obligations. These plans can adjust your monthly payments to better fit your financial situation.

How IDR Plans Work

IDR plans base your monthly payments on your income and family size. Here are key features:

- Capped Payments: Typically, payments will be set at a percentage of your discretionary income (10-20%).

- Loan Forgiveness: After 20 or 25 years of qualifying payments, the remaining loan balance may be forgiven.

This flexibility can help manage monthly financial stress.

Calculating Payments

To calculate your IDR payments:

- Determine Discretionary Income: Subtract 150% of the poverty guideline for your family size from your annual income.

- Apply Payment Percentage: Your IDR plan will designate what percentage of that discretionary income is owed monthly.

For example, if your discretionary income is $20,000, and your plan requires 10%, you’d pay about $167 each month. This method can substantially lower your monthly payments!

Explore Loan Repayment Assistance Programs

Finding effective ways to manage student debt can make a significant difference in your financial health. Loan repayment assistance programs can provide much-needed support.

State-Sponsored Programs

Many states offer loan repayment assistance programs designed to help residents in public service sectors or high-demand professions. Here are a few examples:

- California State Loan Repayment Program: Assists health care professionals in Health Professional Shortage Areas.

- North Carolina’s Forgivable Education Loans for Service: Offers repayment assistance for teachers in critical-need subjects.

These programs often require service commitments in exchange for financial aid.

Employer-Sponsored Programs

Increasingly, employers are recognizing the burden of student loans and offering assistance. You can find:

- Monthly Contributions: Some companies provide direct payments toward your student loans.

- Tuition Reimbursement: If you pursue further education, many organizations cover tuition costs, reducing future debt.

Always check with your HR department to uncover what your employer offers; these benefits can significantly ease your loan repayment journey!

Stay Committed to Repayment

Staying dedicated to your student loan repayment plan requires motivation and a clear vision of your financial future. Keeping your eyes on the prize can help you push through challenging times.

Staying Motivated

To maintain your motivation, consider:

- Tracking Progress: Regularly check your loan balances and milestones.

- Rewarding Yourself: Celebrate small victories by treating yourself when reaching payment goals.

- Joining Support Groups: Connect with others in similar situations for encouragement.

These steps can help keep your spirits high throughout your journey.

Setting Long-Term Goals

Establishing long-term financial aspirations serves as a guiding light in your repayment efforts. Think about:

- Becoming Debt-Free: Visualize the freedom and opportunities that await once your loans are paid off.

- Home Ownership: Consider how eliminating student debt can help you qualify for a mortgage.

- Retirement Savings: Prioritizing loan repayment can pave the way for a more secure financial future.

By focusing on these goals, you’ll be more driven to stay committed to your repayment strategy!

Conclusion

Navigating the complexities of student loans may seem daunting, but with the right strategies, you can take control of your financial future.

Key Takeaways

To effectively pay off your loans faster, remember to:

- Make Extra Payments: This can significantly reduce your principal balance, saving you money in interest.

- Explore Forgiveness Programs: Look into options like Teacher Loan Forgiveness or Public Service Loan Forgiveness to ease your debt.

- Stay Committed: Regularly track your progress and celebrate your milestones along the way.

By implementing these strategies, you’ll be well on your way to achieving financial freedom!